WHAT'S NEW

Police Drama ‘The Rookie’ Reminds Major Character of Privilege: ‘You’re a...

ACCESSORIES

Canada would require incoming worldwide air passengers to check unfavourable earlier...

Meals worth rally sparks warnings of stress on growing nations

Health

Luxurious Rose Bathtub Melts (DIY Recipe) | Wellness Mama

LATEST ARTICLES

Baling Twine: The Latest Advancements in Hay Packaging

Further advancements in technology will enhance baling twine and other tools utilized in hay packaging. In recent years, the agricultural sector has witnessed remarkable advancements in hay packaging, particularly with the innovation surrounding silagewrap.com.au baling twine. This simple yet essential tool has revolutionized the way we store and transport hay, providing farmers with a more efficient and reliable solution. The...

SEO Auckland: Techniques to Boost Your Website’s Rankings

SEO is a critical component in the field of digital marketing. In the fast-paced and ever-evolving world of Internet marketing, SEO in Auckland has become a crucial element for businesses aiming to improve their online presence. A strategy that focuses on SEO, or Search Engine Optimization, can significantly enhance your website's visibility on search engine result pages. Here in Auckland...

Frozen Seafood: Quick and Delicious Meals at Your Fingertips

Frozen seafood not only provides a quick and delicious meal solution, but it also allows you to enjoy the flavours of the ocean, no matter where you are. Undeniably, frozen seafood NZ is an underappreciated gem in the culinary world. It offers a wide selection of options for quick, delicious meals that can be prepared in minutes. Whether it's succulent...

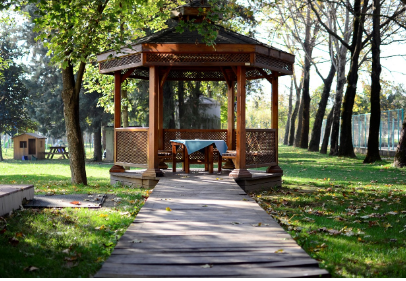

Pergola Builders Adelaide: Creating the Perfect Outdoor Retreat

Choosing the right pergola builder can dramatically influence the outcome of your project. When it comes to enhancing the aesthetics and functional aspect of your outdoor space, working with professional pergola builders Adelaide is key. In Adelaide, many homeowners invest in pergolas to create the perfect outdoor retreat. In Adelaide, pergola builders Adelaide have the skills, experience, and resources necessary...

Commercial Refrigeration Adelaide: The Importance of Reliable Commercial Refrigeration Equipment in Adelaide

Choosing the right commercial refrigeration equipment in Adelaide is a must. It's a smart investment that guarantees the quality of your products, minimises waste, and cuts down on energy expenses. Additional Info/Body: In the fast-paced food service industry in Adelaide, commercial refrigeration Adelaide plays a pivotal role towards success. These systems are used not just to keep food at safe, consumable...

Speech Therapy Adelaide: Unlocking Communication – The Role of Speech Therapy Adelaide in Language Development

Speech therapy in Adelaide plays a pivotal role in language development, mainly when provided in a dedicated, professional environment. Understanding and being understood is a fundamental aspect of human interaction. For some children, this simple act of communication can be a daunting task. It is where speech therapy Adelaide steps in. Speech therapy is a specialised field dedicated to assessing,...

Understanding Different Types of Hearing Aids

Even while more advanced models may cost more, remember that, if necessary, investing in the correct hearing aid will greatly improve your quality of life. We’ve all experienced hearing loss in one form or another as we grow older. Whether you first noticed it when trying to follow conversations in noisy contexts or if it came about suddenly after a...

The Importance of User Experience in SEO: Designing a Website That Ranks

SEO is becoming increasingly important when it comes to website design, as search engine algorithms consider the quality of user experience on a website. In the modern world of online marketing and SEO, user experience is becoming an increasingly important factor in determining how successful a website is. A good user experience can mean the difference between achieving high search...

How Freezing Preserves Flavour and Nutrients in Seafood

Freezing preserves fresh-caught fish's flavour and critical nutrients, such as omega-three fatty acids. Feeling overwhelmed when it comes to choosing the freshest seafood while shopping? You're not alone. With more and more of us turning towards sustainably sourced seafood, many of us are left wondering how best to keep our seafood as full of flavour and nutrients as possible. The...

Luxury and Comfort Combined: The Benefits of a Leather Armchair

If you're looking for a new piece of furniture to style your home or need something more comfortable than an ordinary chair, a leather armchair can provide the ultimate solution. Do you ever feel there is never enough time to take a break and relax? We all have responsibilities, whether work or family tasks, that keep us busy daily. Wouldn't...